Medicare Supplement Plans

Medicare Supplement Plans

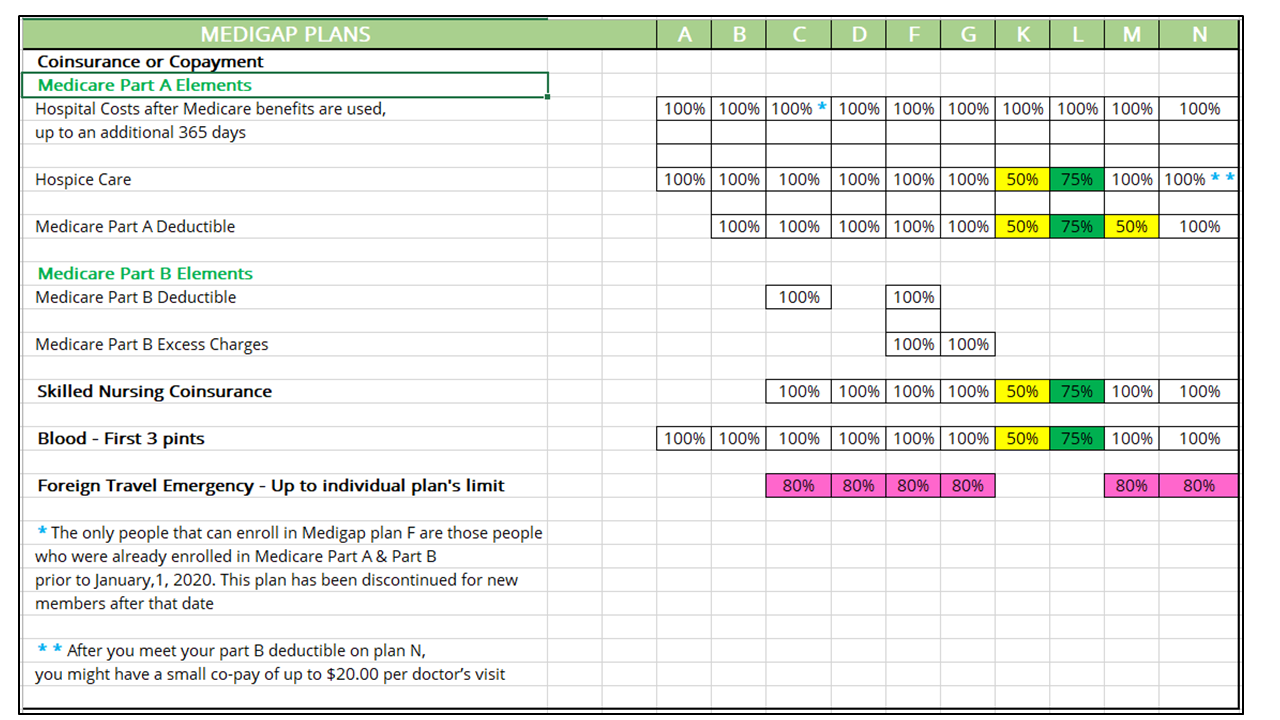

Medicare Supplement, also called Medigap, are plans sold by private insurance companies to fill in the coverage gaps and deductibles that Original Medicare does not cover. For instance, if Medicare covers 80 percent of a doctor’s visit, Medigap will cover the remaining 20 percent. With a Medicare Supplemental plan, there is little additional cost to you for healthcare beyond your premium.

Advantages of a standard Medicare Supplement policy are:

- Choose your own doctor and hospitals

- No referrals required

- You can use it anywhere in the United States as long as they accept Medicare

- You know what your expenses are which makes it easier to budget

Additional elements to know about Medicare Supplement insurance:

- You must have Part A and Part B to buy a Medicare Supplement policy

- Many carriers offer household discounts if two or more people enroll in Medicare supplement plans from the same company

- Plans do not include Part D, so you’ll add a separate standalone Part D drug plan

- Plans do not include dental, vision, or hearing

Helpful Links

Medicare Supplement Eligibility

The Centers for Medicare and Medicaid Services says, “Your individual Medigap Open enrollment Period begins the first day of the month that you are both 65-years-old or older and, enrolled in Medicare Part B. So you have a onetime 6 month window to enroll in a Medigap plan, when there is no medical underwriting. If you enroll during this Medigap Open Enrollment Period, you cannot be denied coverage. If you miss your 6-month enrollment period, you can still apply to enroll in a Medigap plan. All plans have different underwriting benchmarks.

A Quick Recap

✔ Use anywhere in the United States as long as Medicare is accepted

✔ Medigap plans are standardized. The only difference is price.

✔ Medigap plans are standardized. The only difference is price.

✔ You have a onetime 6 month window to enroll in a Medigap plan, when there is no medical underwriting

✔ Medigap plans do not include Part D, so you’ll need to add a separate standalone Part D drug plan

Frequently Asked

Questions

Still have questions? Feel free to contact us for more information.